CSA Releases Updated Guidance on ESG-Related Investment Fund Disclosure

Recently, the Canadian Securities Administrators (CSA) published Staff Notice 81-334 (Revised) - ESG-Related investment Fund Disclosure (the Notice). The Notice updates and replaces the CSA Staff Notice 81-334 originally issued in January 2022 (the 2022 Notice) which we discussed in a previous article.

The Notice expands the guidance published in the 2022 Notice relating to environmental, social and governance (ESG) for investment funds offered by prospectus in Canada.

ESG-Related Classification of Funds

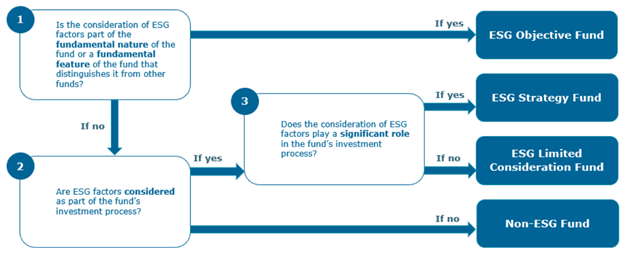

The Notice applies to the following four categories of investment funds offered by prospectus in Canada which are based on whether a fund considers ESG factors as part of its investment process and the extent to which such factors are considered:

- ESG Objective Funds: funds whose investment objectives reference ESG factors

- ESG Strategy Funds: funds whose investment objectives do not reference ESG factors but that use ESG strategies, where the consideration of ESG factors plays a significant role in their investment process

- ESG Limited Consideration Funds: funds whose investment objectives do not reference ESG factors but that use ESG strategies, where the consideration of ESG factors plays a limited role in their investment process (ESG Limited Consideration Funds together with ESG Objective Funds and ESG Strategy Funds are referred to as ESG-Related Funds)

- Non-ESG Funds: funds that do not consider ESG factors in their investment process.

The CSA Staff provide the following decision tree in the Notice to illustrate how an investment fund manager (“IFM”) would classify an investment fund in one of the four categories in the Notice:

The Notice also includes numerous guiding questions to assist IFMs classifying their funds.

New ESG Guidance For All ESG-Related Funds

- Written policies and procedures. CSA Staff observed that some IFMs that manage ESG-Related Funds do not have written policies and procedures relating to the fund’s consideration of ESG factors and/or use of ESG strategies, or in the case of IFMs that are not the portfolio adviser of their funds, their oversight of the funds’ portfolio adviser(s) in relation to the consideration of ESG factors and/or use of ESG strategies. An IFM that offers ESG-Related Funds should: (a) establish, maintain and apply written policies and procedures that cover its consideration of ESG factors and/or use of ESG strategies, or in the case of an IFM that is not the portfolio adviser of the funds, its oversight of the funds’ portfolio adviser(s) in relation to the consideration of ESG factors and/or use of ESG strategies; and (b) have processes in place to ensure that its written policies and procedures are regularly updated, such as for changes in its business practice, industry practice or securities legislation.

New ESG Guidance For ESG Objective Funds and ESG Strategy Funds

- Investment objectives and fund names. A fund that references ESG in its name should primarily invest in assets that meet the fund’s ESG-related criteria. If a fund is permitted to primarily invest in assets that do not meet the fund’s ESG-related criteria, the fund should not reference ESG in its name or investment objectives, as the name or investment objectives would not accurately reflect the primary focus of the fund and would therefore be misleading.

- Funds that track the performance of an ESG-related index. For ESG Objective Funds that reference any aspect of ESG in their name and whose investment objectives indicate that the fund tracks the performance of an ESG-related index, CSA staff’s view is that:

- the ESG focus(es) of the index should be consistent with the ESG focus(es) indicated in the fund’s name; and

- the fund’s investment objectives and/or investment strategies disclosure should indicate that the fund’s portfolio will be comprised primarily of issuers that reflect the ESG focus(es) identified in the fund’s name and investment objectives.

- Unnamed ESG-related index. For ESG Objective Funds whose investment objectives state that the fund will track the performance of an ESG-related index in order to meet its ESG-related investment objectives, but that does not name the specific ESG-related index in the investment objectives, CSA staff’s view is that the investment objectives should clearly identify the ESG-related characteristics of any ESG-related index that the fund will track.

- Investments in issuers that are not index constituents. Where an ESG Objective Fund’s investment objectives indicate that the fund tracks the performance of an ESG-related index but the fund is permitted to track the index by investing in issuers that are not constituents of the index (including by using a sampling strategy), CSA staff’s view is that such issuers should have ESG characteristics that are similar to the constituents of the index, particularly in relation to the ESG characteristics that are relevant to the ESG focus of the fund.

- Funds that invest in underlying funds. For ESG Objective Funds that invest in underlying funds in order to meet their investment objectives, the ESG focus(es) of the underlying funds should be consistent with the ESG focus(es) of the fund. In addition, IFMs are reminded that the holdings of any underlying funds held by a top fund, including any ESG-Related Fund, should be consistent with the investment objectives and strategies of the top fund, including, for example, any exclusionary screening criteria used by the top fund. ESG Objective Funds and ESG Strategy Funds that invest in underlying funds that have an ESG-related focus and/or that employ ESG strategies must describe the process or criteria used to select the underlying funds and should disclose any parameters around the types of ESG focus(es) that the underlying funds will have. In addition, staff’s view is that, if the underlying funds are named in the prospectus, the investment strategies disclosure should describe the ESG strategies that are used by the underlying funds. If the underlying funds are not named in the prospectus, the investment strategies disclosure should describe the ESG strategies that are used by the underlying funds, if known.

- Funds that intend to generate a measurable ESG outcome. Where an ESG Objective Fund intends to generate a measurable ESG outcome, such a fund should clearly state the intended outcome as part of its investment objectives in order to allow investors to identify funds that match their own ESG-related goals. For example, staff encourage funds that aim to reduce carbon emissions to disclose a measurable carbon emissions reduction target in their investment objectives. The inclusion of a measurable ESG outcome in a fund’s investment objectives would also allow funds to provide meaningful continuous disclosure that reports on whether the fund is achieving its intended ESG outcome.

- Funds with carbon offset series. Staff’s view is that, if the name of a series of securities of an investment fund refers to carbon offsetting, the investment objectives of the series should refer to, and explain, the carbon offsetting feature of the series and state that prior approval of securityholders of the series will be obtained before the carbon offset feature of the series is changed.

- Suitability guidance. An ESG Objective Fund may state that it is particularly suitable for investors who have ESG-related investment objectives or who are interested in ESG-focused investments. If the fund is only focused on a particular aspect of ESG, such as gender diversity in leadership or the reduction of carbon emissions, staff’s view is that any suitability statement that indicates that the fund is particularly suitable for investors who have ESG-related investment objectives should accurately reflect the particular aspect(s) of ESG that the fund is focused on.

- Guidance on investment strategies disclosure. All ESG strategies (such as carbon offsetting) that are used as principal investment strategies or as part of a fund’s investment selection process, should be disclosed in the investment strategies section of the prospectus. The investment strategies disclosure of ESG Objective Funds and ESG Strategy Funds should include identifying any ESG factors used and explaining the meaning of each ESG factor and how the ESG factors are evaluated and monitored. This should include an explanation of the types of resources and information used and considered by the IFM in evaluating and monitoring the ESG factors (e.g. third-party sustainability reports, discussions with management of the issuer, disclosure documents), including disclosing whether the evaluation of the ESG factor is quantitative or qualitative and whether the evaluation is conducted using third-party data.

- Funds that use proxy voting or engagement in relation to ESG matters as a principal investment strategy. If a fund uses proxy voting or shareholder or issuer engagement in relation to ESG matters as a principal investment strategy, the fund is required to disclose this in its investment strategies. In staff’s view, the disclosure should include the criteria used by the proxy voting or engagement strategy, the goal of the proxy voting or engagement strategy, and the extent of the monitoring process used to assess the success of the proxy voting or engagement strategy.

- IFMs that apply an ESG strategy to more than one of their funds. In addition to the investment strategies section of a prospectus, exchange traded funds (“ETFs”) and non-redeemable investment funds are required to provide disclosure in the section of the prospectus relating to the IFM about an overall investment strategy or approach used by the IFM in connection with the funds that it manages, which may include any ESG strategies. Similarly, mutual funds that are not ETFs are also permitted to include such disclosure in their prospectus. Where such disclosure is provided in the section of the prospectus about the IFM, staff’s view is that the disclosure should be clear as to which of the funds in the prospectus the ESG strategy applies to, in order to provide transparency to investors as to which specific funds managed by the IFM use the ESG strategy. For example, if the IFM’s approach to considering ESG factors in its investment process varies for different types of funds managed by the IFM, this should be clearly articulated, and the differences clearly explained.

- Funds that use targets for specific ESG-related metrics. If a fund’s use of one or more ESG strategies includes the use of targets for specific ESG-related metrics, such as carbon emissions, staff encourage such funds to disclose those targets as part of their investment strategies and identify if those targets may evolve or change over time in response to changing circumstances.

- Funds that use multiple ESG strategies. ESG Objective Funds and ESG Strategy Funds that use multiple ESG strategies should provide disclosure explaining how the different ESG strategies are applied during the investment selection process. In staff’s view, this disclosure should include the order in which the strategies are applied if the specific order would have an impact on the securities being selected for the portfolio.

- Funds that use ESG ratings, scores, indices or benchmarks. Where an ESG-Objective Fund or ESG Strategy Fund uses internal or third-party company-level ESG ratings or scores, or ESG-related indices or benchmarks, as part of its principal investment strategies or investment selection process, the fund should explain how those ratings, scores, indices or benchmarks are used.

- Funds whose names and/or investment objectives include the term “impact”. In order to avoid greenwashing, if a fund’s name and/or investment objectives include the term “impact”, the investment strategies disclosure should explain what type of impact the fund is aiming to achieve.

New ESG Guidance For ESG Limited Consideration Funds

- ESG Limited Consideration Funds. An ESG Limited Consideration Fund is not required to provide disclosure in its prospectus about its use of ESG strategies (including its consideration of ESG factors in its investment process). Where an ESG Limited Consideration Fund includes statements about the fund’s use of ESG strategies (including its consideration of ESG factors in its investment process) in its sales communications, the prospectus should include disclosure about the fund’s use of ESG strategies. Specifically, if an IFM of an ESG Limited Consideration Fund includes disclosure in the fund’s prospectus about its use of ESG strategies, the disclosure should clearly explain:

- the limited role that the consideration of ESG factors and/or use of ESG strategies plays in the fund’s investment process, including the specific parts of the investment process during which ESG factors are considered, the weight given to ESG factors as a whole (rather than for each particular ESG factor), and the impact that ESG factors will have on the portfolio selection process; and

- whether this approach is specific to the fund in question or whether it is part of the IFM’s general process that is applied across all or a segment of its funds, and if it is applied to only one or a segment of the IFM’s funds, clearly identify the fund(s).

- Funds that are subject to IFM’s general proxy voting or engagement approaches that address ESG matters. Some funds are managed by IFMs that have general proxy voting policies and procedures that address ESG matters among other matters or have a general shareholder or issuer engagement approach that addresses ESG matters among other matters, but the funds do not use ESG-focused proxy voting or shareholder or issuer engagement as a principal investment strategy. Where such a fund is an ESG Limited Consideration Fund, the investment strategies section of the prospectus may include disclosure about the consideration of ESG issues as part of the fund’s proxy voting or engagement approach but should not suggest that ESG-focused proxy voting or engagement is a principal investment strategy of the fund. The investment strategies section should also be clear about the role that the consideration of ESG factors plays in the proxy voting or engagement approach. Where such a fund is a Non-ESG Fund, staff’s view is that the investment strategies section of the prospectus should not include any disclosure about the consideration of ESG issues as part of its proxy voting or engagement approach.

- Funds that may not always use ESG strategies or that use them on a discretionary basis. To the extent that a fund’s investment strategies indicate that a particular ESG strategy may be used but is not always used, staff’s view is that the investment strategies disclosure should explain, where possible, when the ESG strategy will be used, including describing any parameters around when the ESG strategy will or will not be used.

Guidance on Sales Communications of ESG-Related Funds

- ESG Objective Funds. An ESG Objective Fund may include statements in its sales communications that accurately reflect the extent to which the fund is focused on ESG, as well as the particular aspect(s) of ESG that the fund is focused on.

- ESG Strategy Funds. An ESG Strategy Fund may include statements in its sales communications that accurately reflect the types of ESG strategies used by the fund and the extent to which the fund uses ESG strategies. However, such funds should not exaggerate the extent of the fund’s focus on ESG in their sales communications.

- ESG Limited Consideration Funds. An ESG Limited Consideration Fund may include statements in its sales communications regarding the fund’s use of ESG strategies as part of its investment process (including its consideration of ESG factors), but such statements should:

- be clear about the limited role that the consideration of ESG factors plays in the fund’s investment process, including identifying the specific parts of the investment process in which ESG factors are considered, the weight given to ESG factors, and the impact that ESG factors will have on the portfolio selection process; and

- only be included if disclosure relating to the limited role that the consideration of ESG factors plays in the funds’ investment process (including identifying the specific parts of the investment process in which ESG factors are considered) is included in the prospectus. For greater clarity, this includes sales communications relating to the IFM’s ESG investing approach where the consideration of ESG factors plays a limited role in the investment process.

- Non-ESG Funds. A Non-ESG Fund should not refer to ESG in its sales communications, with the exception of factual information about the ESG characteristics of its portfolio (such as fund-level ESG ratings, scores or rankings, or ESG metrics). However, the factual information about the ESG characteristics of its portfolio should not be framed in a way that suggests that the Non-ESG Fund is aiming to achieve any ESG-related goals or is trying to create a portfolio that meets certain ESG-related criteria.

- Sales communications that include fund-level ESG ratings, scores or rankings. Any sales communication that includes fund-level ESG ratings, scores or rankings, including Portfolio-Based ESG Ratings and Portfolio-Based ESG Rankings, must not be misleading. In staff’s view, a sales communication that includes fund-level ESG ratings, scores or rankings may be misleading for a number of reasons, including any of the following:

- there are conflicts of interest involving the provider that prepares the fund-level ESG rating, score or ranking

- the selection of the specific fund-level ESG rating, score or ranking is the result of cherry-picking fund-level ESG ratings, scores or rankings in order to present the fund’s ESG characteristics or performance in a positive light

- the selected fund-level ESG rating, score or ranking is not representative of the ESG characteristics or performance of the fund

- the sales communication does not include explanations, qualifications, limitations or other statements necessary or appropriate to make the inclusion of the fund-level ESG ratings, scores or rankings in the sales communication not misleading.

We’re Here to Help

McCarthy Tétrault has a leading securities regulatory and investment products practice and a multidisciplinary ESG and Sustainability team. We are especially well-equipped to provide investment fund clients with a full suite of advice and support to assist them in integrating ESG thinking into their organizational DNA. With a robust understanding of business, industry, and market drivers, we can deliver contextualized advice and guidance. Please contact the authors to learn more – we would be happy to assist you.